RV Insurance for Class B Camper Vans

Roamly Helps You Save on Class B RV Insurance

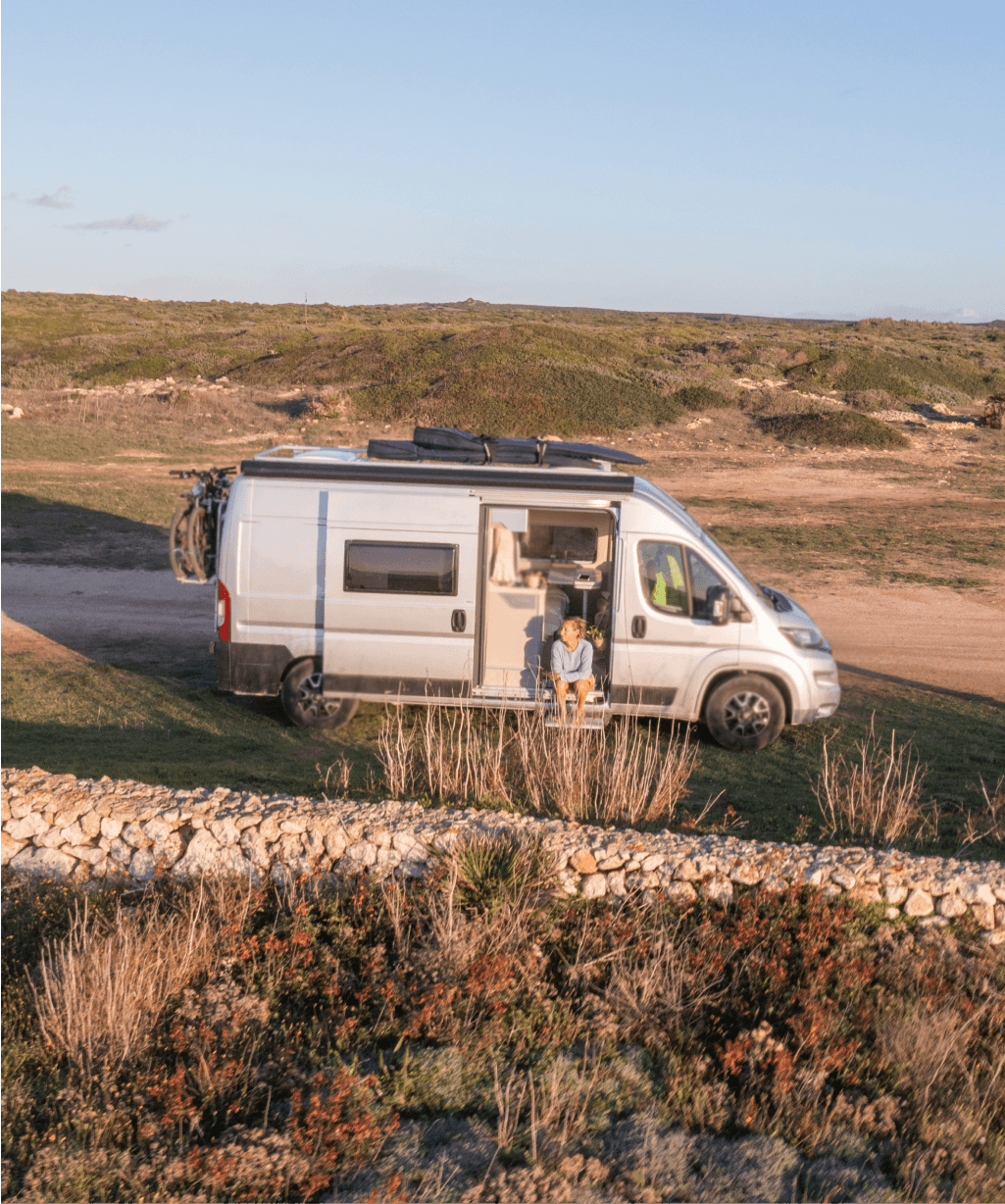

Class B RVs, often known as camper vans, blend the comfort of a larger motorhome with the agility of a van, making them ideal for adventurous spirits seeking convenience and efficiency. These compact wonders come equipped with essential amenities and can comfortably accommodate 2-4 people. At Roamly, we recognize the unique nature of these vehicles and offer class B RV insurance that's as versatile as your travel plans.

Understanding that insurance on a camper isn't a one-size-fits-all affair, we consider factors like your RV's value, usage patterns, driving history, and location to provide a policy that fits your specific needs. With Roamly, you are not just getting insurance for class B RVs; you’re gaining a travel partner as passionate about your motorhome adventures as you are. We are here to help you navigate through varying state requirements and customize your coverage so you can hit the road with peace of mind. Ready to start saving? Let Roamly pave the way to a worry-free journey!

Why Roamly?

Competitive pricing

Roamly customers can save up to 35%* on their insurance premiums compared to other RV insurance companies.

Rental incentives

Roamly policyholders are free to rent out their rig without breaking the terms of their policy.

Full coverage

We offer coverage for all RVs, including unique inventory like DIY and uplifted Class Bs and camper vans.

Class B RVs, or camper vans, are compact motorhomes built on standard van chassis. They offer essential living amenities in a smaller, more agile package, perfect for solo travelers, couples, or small families.

Regular car insurance often isn't sufficient for camper vans. Due to their specific build and use, class B RVs usually require specialized RV insurance for adequate coverage.

Class B RV insurance differs from standard auto insurance by addressing the dual nature of camper vans as both vehicles and living spaces. This insurance often includes enhanced liability, comprehensive, and collision coverage, tailored for the unique requirements of RV living.

Key factors affecting class B RV insurance cost include the RV’s value, how often you use it, your driving record, selected deductibles, and where you reside. These elements help determine the premium based on the risk level.

Yes, full-time insurance coverage is available for those who use their class B RV as a primary residence, offering more comprehensive protection than vacation-use policies.

Still have questions?

Call us at 877.725.1245

Buy Insurance for a Class B RV

Roamly Helps You Save on Class B RV Insurance

* New Roamly customers getting personal policies for travel trailers and Class B RVs tended to see the largest savings of 35% or more off their existing policies when getting comprehensive coverage in 2023. Commercial customers who saw the largest savings while switching to Roamly typically covered between 3-5 vehicles and switched from an existing commercial policy.

Roamly Insurance Group, LLC ("Roamly") is a licensed general agent for affiliated and non-affiliated insurance companies. Roamly is licensed as an agency in all states in which products are offered. Roamly license numbers. Availability and qualification for coverage, terms, rates, and discounts may vary by jurisdiction. We do not in any way imply that the materials on the site or products are available in jurisdictions in which we are not licensed to do business or that we are soliciting business in any such jurisdiction. Coverage under your insurance policy is subject to the terms and conditions of that policy and is ultimately the decision of the buyer.

Policies provided by Roamly are underwritten by Spinnaker Insurance Company, Progressive Insurance Company, Safeco Insurance Company, Foremost Insurance Company, National General Insurance, Mobilitas Insurance Company, and others.

Connect

© 2026 Roamly All rights reserved.